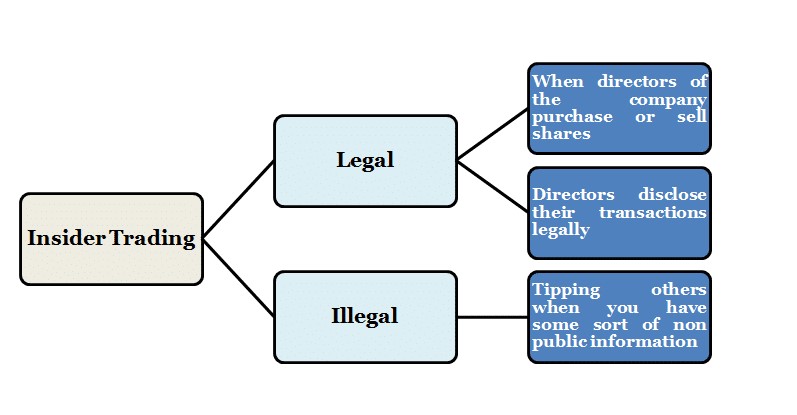

The concept of Insider trading consists of the trading of stocks that belong to public organizations with various types of information. The information may be non-public, materialistic, and related to the core business aspects. Insider trading could be legitimate or non-legitimate depending upon the insider information related to the trade along with the maintenance of the rules and regulations of the USA.

Insider trading mainly showcases insider information where the latter has been considered as the information of non-public. Overall, you can easily state that trading based on insider information is actually insider trading. Surpassing insider information in insider trading could be non-legitimate when any business organization do not fill the appropriate forms in the Security of Exchange Commission. It is obvious that if you are the owner of a small-scale business organization, then the insider information may not necessarily be a person. In such cases, insider information could be materialistic.

The concept of insider trading gets along side-by-side with insider information when the non-public information is given the spotlight during the time of trade execution. Let’s take a couple of things, for example. Consider a small or medium-scale business organization. When the chairman of the board already knows that the manager of the board is about to declare that the share price has increased, the chairman instantly purchases 1000 shares in the name of any relative of the chairman.

This resulted in a boost in profit where the chairman did not even report the traded information to the Securities of Exchange Commission. The information that the chairman got from the manager is insider information. Let’s take another example, for instance. When an employee of a business organization comes to know that the CFO of that particular organization is going to showcase all the dismal results on the earnings call, then the latter tells his/her close one holding the shares of that particular organization to sell them before the declaration of earning call.

In the USA, insider trading is not at all legal, and that is why the Securities of Exchange Commission has been directly involved in several business organizations in order to prevent it. As per several reports in the country, direct evidence of insider information has been quite rare. But there are a few in some small, medium and large-scale business organizations. That is why the Securities of Exchange Commission has initiated various innovative methods to stop insider trading, once and for all.

Two of them turned out to be very effective, and they are activities of surveillance and complaints & tips. The usage of sophisticated tools and digital assistance with big data has helped the commission to get along with the fruitful activities of surveillance. On the other hand, complaints from different types of employees and other personnel are on the losing side of the trade. The commission has brought several insider trading cases against some corporate officers, directors, employees, brokers, government employees, and political intelligence consultants in the USA. The situation got even worse when the commission came to know about the breach of confidential information in several family businesses.

Read More Blogs: https://bestpopularnews.com/guide-to-purchasing-ratchet-straps/

More Stories

Jessica Stein: Review A Financial Visionary and Top Broker at Maplewells.ca

Decoding the Impact of AI on Digital Marketing: A Look at WordPress Multisite

Evading SEO Pitfalls: Amplifying your Business through an Experienced SEO Agency